S&P 500 sector exchange-traded funds (ETFs) present a compelling investment avenue for investors seeking to allocate their portfolios. These ETFs track the performance of specific sectors within the broad S&P 500 index, such as technology, healthcare, and consumer discretionary. By investing in sector-specific ETFs, investors can gain exposure to industries that match with their investment goals. Evaluating the characteristics of each sector and its current market conditions is crucial for making informed investment decisions.

A well-diversified portfolio often features allocations to multiple sectors, helping to minimize risk and enhance portfolio performance. For example, an investor pursuing growth might prefer technology or healthcare ETFs, while a more risk-averse investor might choose sectors such as utilities or consumer staples. Regularly evaluating your sector allocations and rebalancing your portfolio based on market trends and personal needs can facilitate a successful long-term investment strategy.

Unlocking Sectoral Growth: Analyzing S&P 500 Sector ETF Performance

Investor proficiency with the global market often hinges on an ability to interpret the performance of various sectors within that market. The S&P 500, a benchmark index comprising large-cap U.S. companies across diverse sectors, provides a valuable lens for assessing these trends. By investigating the performance of S&P 500 sector ETFs, investors can gain crucial insights into the fluctuations driving growth and potential investment possibilities.

Ongoing market conditions have resulted in substantial variations across sectors. Some sectors, such as technology and consumer discretionary, have exhibited robust growth, while others, like energy and financials, have faced challenges. Understanding these discrepancies is essential for formulating a well-balanced portfolio that mitigates risk while maximizing potential returns.

- Sectoral ETFs provide a specific investment approach, allowing investors to zero in on particular industries or themes within the broader market.

- Analyzing sector ETF performance can reveal underlying shifts that may not be immediately obvious through a general market lens.

- By monitoring sector ETFs over time, investors can gain valuable insight into past performance, which can inform future investment strategies.

As the market evolves continuously, a proactive approach to sector analysis is crucial. By exploiting the insights gleaned from S&P 500 sector ETFs, investors can align their portfolios for success in an increasingly multifaceted market landscape.

Highest-Yielding S&P 500 Sector ETFs for Your Portfolio

When constructing a well-diversified portfolio, incorporating sector-specific exchange-traded funds (ETFs) can be a wise move. Traders seeking exposure to the high-performing sectors of the S&P 500 index should consider a range of ETFs that track these industries. Some of the most popular sector ETFs in recent times include those focused on healthcare, as these fields have consistently demonstrated solid performance. When choosing an ETF, it's important to analyze its underlying holdings, expense ratio, and historical record.

- IT ETFs:

- Healthcare ETFs:

- Financials ETFs:

Managing Market Volatility during S&P 500 Sector ETFs

The stock market is renowned for its inherent volatility, presenting both opportunities and risks to investors. Throughout periods of market turmoil, a strategic approach can help reduce potential losses and capitalize on emerging trends. One such strategy involves leveraging S&P 500 sector ETFs, which provide targeted exposure to specific sectors of the economy. By diversifying investments across various sectors, investors can enhance their portfolio's resilience to market fluctuations.

- Analyze sector ETFs that align with your financial goals and risk tolerance. Study the historical trends of different sectors to identify those faring well in the current market environment.

- Regularly track your ETF holdings and rebalance your portfolio as needed. This ensures that your investments remain aligned with your targets.

- Remain informed about global factors that can influence sector performance. Market news and reports can provide valuable insights for making informed investment choices.

Remember that market volatility is a natural phenomenon, and diversification remains a key strategy for navigating uncertain conditions. By adopting a disciplined Top performing sector ETFs approach and proactively managing your investments, you can increase your chances of achieving your long-term financial objectives.

Dive into The Ultimate Guide to Investing in S&P 500 Sector ETFs

Embark on a journey that unravels the complexities of investing in S&P 500 sector ETFs. These powerful investment tools allow you to diversify your portfolio by focusing on specific sectors within the U.S. stock market. Whether you're a seasoned investor or just {beginner, this comprehensive guide will provideknowledge to navigate this exciting landscape.

- Let's begin by understanding the fundamentals of ETFs and how they contrast with traditional investments..

- Dive deep into the diverse sectors that make up the S&P 500 index, offering valuable insights on their performance.

- Finally, we'll strategies for selecting and managing your sector ETFs successfully.

Sector Diversification: The Power of S&P 500 Sector ETFs

Strategic portfolio allocation is a cornerstone of successful investing. Traders seeking to mitigate risk and enhance returns often turn to sector diversification as a key strategy. Sector Funds tracking the performance of various sectors within the S&P 500 provide a convenient way to achieve this diversification. By putting capital across diverse sectors like technology, finance, and energy, investors can reduce their exposure to market fluctuations within any specific sector.

- Furthermore, sector ETFs offer clarity into the underlying holdings, allowing investors to understand their exposure across different industries.

- Therefore, S&P 500 sector ETFs provide a valuable tool for investors looking to create a well-diversified portfolio that aligns with their risk tolerance and aspirations.

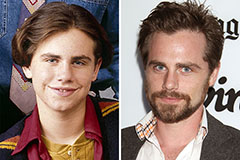

Rider Strong Then & Now!

Rider Strong Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!